This article discussing the unfair cost of insurance in North Queensland has been provided by Tyrone Shandiman, Strata Insurance Solutions. This article has been updated in May 2021 in light of the Government backed $10 billion reinsurance pool to assist Northern Australia policy holders.

Table of Contents:

- QUESTION: Why does Central Queensland fall under North Queensland for insurance purposes? Even though we’ve had no claims for over ten years, insurance companies won’t quote or are governed by a maximum insurance amount of $5 million.

- QUESTION: Access to insurance in FNQ, especially for small strata schemes, is expensive and hard to find. With $100k excess charges for a named cyclone, how do small strata schemes navigate this?

- QUESTION: We got a James Cook University Cyclone Resilience Report. If we do not act on the report’s practical measures in relation to making our building more resilient to cyclones, can this be used by an insurer to avoid a claim for cyclone damage?

- QUESTION: In FNQ, insurance is so high, body corporate committees are not doing sinking fund forecasts and if they are doing them, they are ignoring the recommendations in the sinking fund report. What can we do?

- QUESTION: I own a home within a strata title village in FNQ with a total of 17 homes. Our current insurance cover is $4,500,000. Are we eligible to be included in the reinsurance scheme?

- QUESTION: In relation to strata properties with holiday letting in far North Queensland, insurers are declining to quote on policies for any property with over 50% holiday let.

- QUESTION: Our committee has gone to the BCCM to organise Alternative insurance cover for our North Queensland property, but were told they had to have insurance in place.

- ARTICLE: Government Backed $10Billion Reinsurance Pool to Assist Northern Australia Policy Holders

- ARTICLE: Self-Insuring Cyclone Cover – North Queensland

Question: Why does Central Queensland fall under North Queensland for insurance purposes? Even though we’ve had no claims for over ten years, insurance companies won’t quote or are governed by a maximum insurance amount of $5 million.

- Why is Sure the only insurance company willing to insure our 17 lot strata building? Over the the past 13 years, although we’ve had a cyclone, high winds and hail storm, we haven’t had a claim.

- Our building replacement is $7 million. According to Govt legislation, Sure Insurance’s maximum insurance cover is $5 million. Insuring for the extra $2 million is excessive.

- We are in the Govt Reinsurance ARPC scheme and have been told by our insurers that because of this, we have had a minimal increase in this year’s policy. Can we ask the insurer to disclose the amount to ensure we get the full reduction?

Answer: Recent changes have resulted in significant consumer wins and should provide better coverage options.

The challenges faced in Northern Australia are related to cyclone risks affecting areas north of Gladstone on the Queensland coast. This issue impacts consumers in both northern and central Queensland who are located above this region.

We understand your frustration with the limited options available. ACIL has been actively lobbying insurers to increase their capacity in Northern Australia following the implementation of the Cyclone Reinsurance Pool (Pool). We are pleased to inform you that Sure is now offering $20 million in capacity as a direct result of the Pool. This increase is a significant win for consumers, including those in your situation, and should provide better coverage options.

The previous limit of $5 million for Sure’s insurance cover has now been addressed, with the new capacity increase to $20 million. This should help alleviate the issue of needing additional cover for your building replacement cost of $7 million.

Insurers are not required to disclose specific premium savings resulting from the Cyclone Reinsurance Pool. However, the ACCC is monitoring to ensure insurers pass these savings on to consumers.

We hope to see more savings from the Cyclone Reinsurance Pool as it expands to benefit more consumers.

Tyrone Shandiman

Australian Consumers Insurance Lobby

E: info@acilobby.org.au

P: 07 3185 5256

This post appears in Strata News #701.

Question: Access to insurance in FNQ, especially for small strata schemes, is expensive and hard to find. With $100k excess charges for a named cyclone, how do small strata schemes navigate this?

In FNQ, a severely limited number of insurance companies are willing to insure strata buildings because of the risk of cyclone and flood events. The pool of insurers becomes even more restricted for small strata complexes.

We have one insurance company available, and they charge enormous premiums and $100K excess charges in the event of a named cyclone and/or storm surge flooding.

How can we reach a broader base of companies willing to insure small strata schemes in FNQ?

How do we deal with potentially $200K worth of excesses if a named cyclone trashes and floods our strata without charging a $7K+ special levy per lot?

A small strata does not carry the cash needed to absorb this large outlay.

Answer: The cyclone reinsurance pool should come into force for insurers in the coming 6-7 months, and this should mean more insurers offering cover at a more affordable rate.

With a building of more than 10 lots insured for a sum greater than $5million, currently limited insurers will quote. Usually, the holding insurer is the most likely insurer to offer cover.

Notwithstanding, the cyclone reinsurance pool should come into force for insurers in the coming 6-7 months, and this should mean more insurers offering cover at a more affordable rate.

You may consider changing the expiry date to 1st January 2024, as that is when all insurers must come on board with the cyclone reinsurance pool.

If you haven’t paid the policy, it may be worth speaking with a broker as they may be able to offer the same policy on a no commission and fee for service basis, which may save you in premium. Likewise, they may have other insurers available that have not been considered.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in the July 2023 edition of The QLD Strata Magazine.

Question: We got a James Cook University Cyclone Resilience Report. If we do not act on the report’s practical measures in relation to making our building more resilient to cyclones, can this be used by an insurer to avoid a claim for cyclone damage?

Answer: Insurers have, in the past, sought to conduct a search of body corporate records to determine whether there have been non-disclosure issues associated with major claims, so it is important that you consider your duty of disclosure.

There are 2 considerations to this question – it really depends on what the report says and whether there are defects or building issues brought to your attention or if the report only provides maintenance recommendations.

Firstly, you need to consider whether an exclusion applies and the first thing that comes to mind is the exclusion in most strata policies for “non-rectification of defects errors or omissions that you were aware of” (“non-rectification exclusion”).

If the insurer can demonstrate that you were aware of a building issue, including an issue that is brought to your attention in a JCU report, but you failed to act and that resulted in a claim – the insurer may apply the non-rectification exclusion.

Secondly, your duty of disclosure requires you to disclose all things relevant to the insurer’s decision to insure you – failure to do so can result in the insurer voiding the insurance policy. The duty of disclosure applies when the policy is taken out, renewed or altered. Depending on what is disclosed in the report, you may need to make a disclosure to the insurer and if you have an issue in a JCU report and are unsure about whether it should be disclosed, you should speak with your broker or strata manager for further advice. Insurers have, in the past, sought to conduct a search of body corporate records to determine whether there have been non-disclosure issues associated with major claims, so it is important that you consider your duty of disclosure.

If the JCU report only recommends standard maintenance considerations (like clearing gutters, trimming trees etc), this may not impact your insurance.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in Strata News #627.

Question: In FNQ, insurance is so high, body corporate committee’s are not doing sinking fund forecasts and if they are doing them, they are ignoring the recommendations in the sinking fund report. What can we do?

Strata Insurance Issues in Far North QLD (FNQ).

Insurance is so high, body corporate committee’s are not doing sinking fund forecasts and if they are doing them, they are ignoring the recommendations in the sinking fund report. A vast majority of levies is going to insurance. In FNQ, insurance for a block of 21 units is around $110K so, to keep strata fees down, garden maintenance is cut, building maintenance is cut etc.

As a lot owner, I’m concerned about where this leaves us. What can we do?

Answer: Regardless of the cost of insurance, a body corporate cannot neglect maintenance of the building or common property.

The Australian Gov has pledged $10 billion toward a Northern Australian reinsurance pool. This is designed to assist firstly with your comment on high insurance premiums. Hopefully over the next year or so we will see a drop in the extreme premiums in FNQ as a result of this government backed scheme.

Regardless of the cost of insurance, a body corporate cannot neglect maintenance of the building or common property. It has a legal duty to maintain the property regardless of individual owners and their financial standing. It is important for owners to note that failed and neglected maintenance is inevitably going to lead to higher insurance premiums. The more frequently the BC has to claim for water leaks, injuries on common property etc, the insurance premiums will continue to skyrocket.

If necessary, the BC may need to consider taking a loan to raise the relevant funds and repair/ complete the required maintenance.

Worth noting as well, failed garden maintenance and failed building maintenance will have an adverse effect on the value of the owners units. Poorly presented schemes, lacking in maintenance, are going to be very hard for an owner to sell or lease their unit and gives rise to the question of compensation to owners because the body corporate has failed its duties.

Dakota Panetta

Solutions in Engineering

E: dakotap@solutionsinengineering.com

P: 1300 136 036

This post appears in the November 2022 edition of The QLD Strata Magazine.

Question: I own a home within a strata title village in FNQ with a total of 17 homes. Our current insurance cover is $4,500,000. Are we eligible to be included in the reinsurance scheme?

I own a home within a strata title village where there are a total of 17 homes, our current cover is $4,500,000. We live in FNQ.

Naturally, there are many questions regarding the federal government’s reinsurance pool which become effective July 1 2022. Our insurance is not due until November 2022 and getting information from a broker has not been easy, as they don’t really look into the reinsuring until 6 weeks prior to renewal. We have been told that we may not be eligible to be included in the reinsurance scheme, so my question is why not?

Answer: Properties greater than 50% residential will be eligible under the reinsurance scheme.

Under the Federal Government Cyclone and Cyclone-related Flood Reinsurance Pool, properties greater than 50% residential will be eligible under the reinsurance scheme.

Notwithstanding, insurers are not required to join the reinsurance pool on 1st July 2022.

Large insurers have until December 2023 to have all eligible policies transferred into the pool and smaller insurers until December 2024.

It is possible that some (or all) insurers may not start offering policies under the reinsurance arrangement when it first comes in to effect.

Negotiations are currently underway with insurers and the federal government on the implementation of the reinsurance pool and there have currently been no announcements by insurers on their participation in the reinsurance pool.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in the June 2022 edition of The QLD Strata Magazine.

Question: In relation to strata properties with holiday letting in far North Queensland, insurers are declining to quote on policies for any property with over 50% holiday let.

In relation to strata properties with holiday letting in far North Queensland, insurers are declining to quote on policies for any property with over 50% holiday let. Others such as suncorp, will only quote on properties of up to 40% holiday let. What can be done for these who are over these percentages to obtain a quote for insurance?

Answer: It comes down to going to the entire market, finding all your available options.

I do just have to say that the situation in North Queensland and Northern Australia is very, very dire. There are many buildings that are struggling to find insurance. The main issue is ‘Can the body corporate tell owners that they can or can’t use holiday letting within their lot?‘. Obviously, that’s a very hot topic at the moment. I don’t believe the case law is in favour of that.

It comes down to going to the entire market, finding all your available options. If there’s a requirement for certain percentages, it might be worthwhile talking to some of the owners as a committee and saying, ‘Hey, we need to bring this number down. Instead of letting these lots out, can we have some owners that elect to not holiday let their properties?’, and failing that, I guess it’s looking at what are the other options available with other insurers.

I’m hoping that in the coming years and leading up the federal elections, there might be a change of stance from the government on how they handle Northern Australia. My personal preference would be for a government backed reinsurance pool Corporation, to provide catastrophe insurance to insurers for things like Cyclone and terrorism and other perils that they’re not insuring. But time will tell as to how the government they’ve had quite a while Time will tell as to what they do or if they do anything about it.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 07 3899 5129

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisernet Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in the June 2021 edition of The QLD Strata Magazine.

Question: Our committee has gone to the BCCM to organise Alternative insurance cover for our North Queensland property, but were told they had to have insurance in place.

Our committee has gone to the BCCM to organise an Alternative cover for our 46 units plus restaurant, but were told they had to have an insurance in place.

We are now paying $355,000 for no cover for cyclones, storms or flood which in North QLD is a must. We are also paying a separate policy for public liability.

A full coverage was over $600,000 but this was dismissed by the Secretary

Where to go from here?

Answer: It is recommended where the committee are unable to meet their requirements to insure in accordance with the BCCM Act, that owners are involved in any decision making about an insurance policy.

Can I recommend the owner is referred to the information in the article below.

It is recommended where the committee are unable to meet their requirements to insure in accordance with the BCCM Act, that owners are involved in any decision making about an insurance policy. The secretary may be exposing themselves to legal liabilities if on their own volition, they decide to dismiss a proposal of insurance that complies with the BCCM Act where there are no other compliant proposals up for consideration.

If the owner does not believe the committee or a committee member are acting reasonably with regard to the proposals of insurance, they can refer an application for the Commission to deal with a dispute in relation to the arrangement of insurance.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 07 3899 5129

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisernet Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in Strata News #483.

ARTICLE: Government Backed $10Billion Reinsurance Pool to Assist Northern Australia Policy Holders

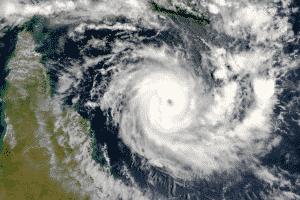

The Federal Government has recently announced a $10billion reinsurance pool which has been introduced to address issues of affordability and availability of insurance for policy holders in Northern Australia.

Insurance premiums, excess and terms & conditions for policy holders in Northern Australia are significantly less favourable than elsewhere in Australia. Those conditions mean that in extreme circumstances, premiums can be as much as twenty times the cost of insurance than in other parts of Australia. Policy conditions, such as exorbitant excesses as much as $500,000, can also mean that there is no access to cover when a policy holder needs it.

The cost of insurance has forced many policy holders into a position of not insuring or underinsuring because insurance is unaffordable or not available.

The newly announced measure will mean the government will provide reinsurance to private insurance companies for cyclones and related flood damage.

The government anticipates the new measure will deliver a saving of more than $1.5billion for a period of 10 years for household, strata & small businesses. An additional $40million will be provided as an investment in making older strata buildings more resilient to cyclone and other extreme weather events.

The devil will be in the detail and the federal government will be working on the design of the program with various stakeholders over the coming 12 months.

It remains to be seen whether the newly announced measure will assist the right demographic and provide meaningful assistance in addressing the affordability and availability of insurance for impacted policy holders. The government have not yet provided information on how much premiums may fall by.

The program is scheduled to take effect from July 2022.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 07 3899 5129

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisernet Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in the May 2021 edition of The QLD Strata Magazine.

Read more:

- Federal government announces reinsurance pool to cover cyclone damage in northern Australia

- QLD: Northern Australia Reinsurance Pool to Bring Long Overdue Relief for Strata Owners and Residents

ARTICLE: Self-Insuring Cyclone Cover – North Queensland

The cost of insurance in North Queensland (& other parts of Northern Australia) is placing an unreasonable burden on bodies corporate, in some cases premiums are twenty times more than the cost of insurance in other parts of Australia.

La Nina weather patterns expected in the coming cyclone season has forecasters’ anticipating higher frequency and severity of cyclone events. So, while the expense related to insurance may seem unreasonable, the need for insurance is arguably more important in the coming cyclone season than in past seasons.

La Nina weather patterns expected in the coming cyclone season has forecasters’ anticipating higher frequency and severity of cyclone events. So, while the expense related to insurance may seem unreasonable, the need for insurance is arguably more important in the coming cyclone season than in past seasons.

Compliance with legislative requirements to have insurance for full replacement value is becoming more and more difficult for bodies corporate. This is following the withdrawal of a number of key insurers in recent years and other insurers changing guidelines to reduce their appetite for insuring buildings in North Queensland.

This article will consider a number of aspects in relation to self-insurance and we will base our article on The Body Corporate and Community Management (Standard Module) Regulation 2008 applying. It should be noted new regulation comes into effect in March 2021 with similar provisions. While this article provides opinion on certain provisions of the legislation, the commissioner and ultimately judges have a higher authority on any determination or application of legislation.

Ways of “Self-insuring”

Self-insuring can be done in several ways and can mean the body corporate:

- takes out a policy with a very high cyclone excess;

- takes out a policy with a cyclone exclusion;

- does not take out insurance at all.

We will explore these three ways of self-insuring in further detail.

High Cyclone Excess

High cyclone excesses are one consideration for the body corporate.

Insuring a $5,000,000 building and electing say a $1,000,000 or even $5,000,000 cyclone excess may comply with section 179 to insure the building for damage for the reinstatement of property to its condition when new.

Notwithstanding, section 184(2) requires that the excess does not impose an unreasonable burden on owners of individual lots.

An owner may be in a position to suggest that the election of a $1,000,000 or higher cyclone excess, when a much lower excess option was available, would create an unreasonable burden on the owner. Particularly if there was a claim affecting only one lot and the lot owner was responsible for the excess.

An owner may be in a position to suggest that the election of a $1,000,000 or higher cyclone excess, when a much lower excess option was available, would create an unreasonable burden on the owner. Particularly if there was a claim affecting only one lot and the lot owner was responsible for the excess.

To reduce the burden on a lot owner/s, the body corporate may pass a motion at a committee or general meeting that in effect means the body corporate pays the excess for all cyclone claims, given all owners are benefiting from lower premiums. This may avoid an instance where one lot owner then becomes responsible for the excess.

Contrary to this, it may be argued that say for instance a $1,000,000 cyclone excess paid for by the body corporate still creates an unreasonable burden on owners; for example a $1,000,000 excess paid for by 20 units would cost $50,000 per lot. Likewise, if say only one or two lots suffered severe damage of say $100,000 each and this was below the excess, it may be argued the excess may create an unreasonable burden on owners. The body corporate is not able to pay for repairs inside an owner’s lot in instances where a claim falls below excess.

Legislation remains silent on any consideration the burden of excessive premiums is having on owners.

Cyclone Exclusion

In a search of body corporate commissioner decisions, we were unable to find any reference material on this particular point.

Section 179 and Section 176 of Standard Module Regulation requires cover for “storm damage” to be insured by the policy. Storm damage is not only limited to cyclone, for example, other types of storms can include (but not limited to) hail, thunderstorm, heavy rain/winds etc.

So, this brings the question of whether insuring for storm damage but specifically excluding the event of cyclone is compliant?

The legislation is not quite clear on whether the policy must cover all types of storm without the possibility for certain exclusions (such as cyclone category 1-5). If this is the case, no insurance policy in Australia would comply with the requirements in regulation if certain events could not be excluded.

Regulation states that damage, for coverage under strata insurance must include (among other things) “…earthquake, explosion, fire, lightning, storm, tempest and water damage…”. Below are common exclusions in strata insurance policies today where compliance would be an issue if there was a requirement to insure these events in all circumstances without the ability to exclude certain events.

- Action from the sea, high water or tidal wave (water damage),

- Flood (water damage),

- Where the building is unoccupied for more than sixty days (all types of events),

- Damage due to warlike activities (fire, explosion),

- Damage caused intentionally (fire).

- Damage indirectly caused by faulty workmanship (all events).

Strata Insurance Solutions believes there may be a fair argument to suggest that a policy covering storm damage but excluding damage caused by cyclone category 1-5 can comply with the act, factoring in other examples stated above.

We would be interested to hear the commissioners’ position on this.

Alternate or No Insurance

Regulation requires that the body corporate must among other things, insure for the reinstatement of property to its condition when new for full replacement value.

Where a body corporate cannot comply with this requirement, section 179(4) provides that the commissioner may authorise a form of “alternative” insurance.

It is important to understand that having no cover whatsoever is a contravention of the act and not considered “alternative” insurance. The commissioner can authorise alternate cover if they are satisfied that what is being proposed gives cover that is as close as practicable to the requirements in the act. For example, in one instance the commissioner approved a combined cover amount of 70% of the full replacement value; in that case, the commissioner determined having some cover was better than no cover at all.

A decision to self-insure does not constitute alternative insurance and cannot be approved by the Commissioner. The only way to have a “no insurance” whatsoever would be for the body corporate to blatantly disregard the requirements under the BCCM Act; this could expose the body corporate to fines and penalties and expose the office bearers to legal negligence claims.

If you are considering alternative insurance we recommend reading Practice Directions (no. 28) which provides more guidance on an application for alternative insurance.

Risk management

If the body corporate does end up considering a form of self-insurance for the risk of cyclone, the body corporate should place strong consideration into managing its exposure to cyclone damage.

We recommend consideration is placed into contacting James Cook University for a Cyclone Resilience Report.

This FREE report can be ordered by filling the form NQSIP, the report gives practical measures bodies corporate can consider in relation to making their building more resilient to cyclone.

Tyrone Shandiman

Strata Insurance Solutions

T: 07 3899 5129

E: tshandiman@iaa.net.au

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances and the specific coverage afforded under their policy wording. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisernet Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in Strata News #413.

Have a question about the unfair cost of insurance in North Queensland or something to add to the article? Leave a comment below.

Read Next:

Visit Strata Insurance OR Strata Legislation QLD

After a free PDF of this article? Log into your existing LookUpStrata Account to download the printable file. Not a member? Simple – join for free on our Registration page.

The committee managed to get suitable insurance which included cyclone, flood and storm for our complex and put it to an EGM but it was not carried as an owner got 25% of owners to vote on her motion to move to another Body Corp company who guaranteed to provide insurance that was supposedly $200,000 cheaper although there was not a formal proposal. How is this right?

Hi,

It may not be right but I suspect there is a bigger story here. It certainly sounds unusual that the body corporate company would guarantee a lower fee but perhaps there is paperwork to back that up and if that is what is delivered is it a bad outcome? I think the best thing to do would be to contact the appointed managers and ask them for a clear explanation of how they can deliver on the promise.

Could getting a James Cook University Cyclone Resilience Report and then not acting on. the report’s practical measures in relation to making our building more resilient to cyclone be used by an insurer to avoid a claim for cyclone damage?

Hi Stuart

Tyrone Shandiman, Strata Insurance Solutions has responded to your question in the above article.

Hi George

I have been asked to respond to your enquiry by Lookup Strata.

Unfortunately, government charges are unavoidable – like with any tax. In 2017, the NSW government legislated the removal Emergency Services Levy for insurance which would have meant that the levy was in line other states, however the government did not proceed with the changes over concerns the new funding model may have harmed small-to-medium businesses.

One way that you can reduce levies if your policy is managed by a broker and subsequently has commissions built in to the policy is to ask the broker to offer the policy on a fee for service basis rather than a commission basis – because fees do not attract Emergency Services Levy. If the commission on your policy is 20% this should reduce your levies by 20%. Our company provides our services on a fee for service basis for the very fact there is a saving in government duties. One other consideration to reduce insurance costs (and not just levies) is to also re-market your policy as any further saving in premium will not only reduce levies but the final cost that is levied to owners.

It is our understanding that the levy may be reviewed in future and one owners can do to assist is writing to your local NSW Government MP asking them to re-review their decision to include Fire Service Levy into insurance premiums.

Please feel free to contact me if you would like to discuss this further.

Tyrone Shandiman

Strata Insurance Solutions

http://www.stratainsurancesolutions.com.au

tshandiman@iaa.net.au

1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisernet Australia AFSL No 240549, ABN 15 003 886 687.

What as a strata owner can I do about the cost of the Government charges for my building insurance?