This article about yearly increases to strata insurance has been provided by Tyrone Shandiman, Strata Insurance Solutions.

Table of Contents:

- QUESTION: Can the owners corporation structure the strata insurance so a lot owner cannot claim under the policy? Is this a viable way for owners corporations to manage the claims history and the adverse impacts of claims unrelated to common property?

- QUESTION: If the council prefers owners not to make insurance claims to prevent future premium increases, is the strata company liable for repair costs?

- QUESTION: Strata managers appear to be getting pushed to use a broker as there are limited online insurer portals. Why is this?

- QUESTION: We do not have direct contact with our broker. We work through our strata company. Can our owners corporation contact our broker directly?

- QUESTION: Do we need an insurance broker? What does an insurance broker do?

- QUESTION: In NSW, is the strata insurance premium dependent on whether lots are owned outright without mortgages? In our block of 10 units, half of the lots are fully owned and mortgage free. Can we get a better deal on our insurance?

- QUESTION: Is there a regulated fixed percentage scale by which insurance companies increase their premiums each year? If so, what is it?

Question: Can the owners corporation structure the strata insurance so a lot owner cannot claim under the policy? Is this a viable way for owners corporations to manage the claims history and the adverse impacts of claims unrelated to common property?

Answer: Someone who pays for insurance and is an insured party has a right to make a claim on that policy.

A lot owner is an insured party to the policy. They contribute to their building’s insurance and have an insurable interest in the property.

When you buy a strata property, you purchase the claims history of the building. This is simply one of the things that you can’t avoid. The only way to prevent this is to not own in strata.

It’s crucial to understand that someone who pays for insurance and is an insured party has a right to make a claim on that policy. However, the owners corporation also has a role to play. They can negotiate specific excesses, such as in the case of water damage issues, where they can request voluntary higher excesses. Alternatively, they can recommend owners take action to maintain their property to reduce those claims.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in the June 2024 edition of The NSW Strata Magazine.

Question: If the council prefers owners not to make insurance claims to prevent future premium increases, is the strata company liable for repair costs?

Answer: Owners have an insurable interest in the strata insurance policy and are entitled to make a claim for valid insurable damage.

When dealing with situations where the committee might prefer that an owner does not file an insurance claim to avoid potential increases in future premiums, it’s essential to understand the following considerations:

- Right to Claim: A strata company cannot prevent an owner from making an insurance claim. Owners have an insurable interest in the strata insurance policy and are entitled to make a claim for valid insurable damage. If an owner decides to proceed with a claim, they have the right to contact the insurer directly to assert their claim, independent of the council’s preferences.

- Strata Company’s Financial Responsibility: The question of whether the strata company is able to cover the costs of damage instead of making a claim is complex. Generally, the strata company’s responsibility to pay for repairs within individual lots is determined by the governing legislation and the specific by-laws of the strata company. There are legal and regulatory boundaries that dictate what a strata company can spend funds on and this is usually associated with maintenance of common property. If the legislation or the strata company’s by-laws do not explicitly require the strata company to cover these costs, or if the strata company is not otherwise legally liable for the repairs, then it may not be appropriate or even legal for the strata company to pay for damages that a lot owner is responsible for.

In this instance, it is recommended the strata company seek advice from their strata manager based on the specific circumstances of the claim before deciding the most appropriate action to proceed with.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in the May 2024 edition of The NSW Strata Magazine.

Question: Strata managers appear to be getting pushed to use a broker as there are limited online insurer portals. Why is this?

Answer: By engaging with an insurance broker, the strata manager enhances the owners corporation’s access to a broader range of insurers.

Certain insurers, typically five to six, exclusively work with insurance brokers. This preference is attributed to factors such as reduced marketing expenses and less stringent conditions under an Australian Financial Services License when dealing with insurance brokers.

Consequently, it could be advantageous for strata managers to engage an insurance broker, enhancing the owners corporation’s access to a broader range of insurers.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in Strata News #677.

Question: We do not have direct contact with our broker. We work through our strata company. Can our owners corporation contact our broker directly?

Answer: The owners corporation should be able to deal directly with the insurance broker.

The owners corporation can ask that they deal directly with the insurance broker.

If that is not allowed, they should consider moving to an arrangement that allows them to do so by finding a broker who will deal directly with the committee.

In some strata management contracts, you pay an additional strata management fee if you insure with a broker that does not pay the strata manager a commission.

At the renewal of your strata management contract, ensure such clauses are not included in the contract.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in Strata News #656.

Question: Do we need an insurance broker? What does an insurance broker do?

Answer: Insurance brokers play an important role in the arrangement and facilitation of strata insurance.

Insurance brokers play an important role in the arrangement and facilitation of strata insurance. The role of an insurance broker includes:

- Advice – We specialise in insurance. That’s all we do! It is accepted that insurance brokers are more qualified to give advice in relation to insurance products and we are licensed to give personal advice specific to your individual needs and circumstances. Strata managers and insurers can only provide general advice and are unable to provide advice specific to your needs or circumstances.

- Broader access to insurers – Some insurers (currently five to six) deal only with insurance brokers. Using a broker can provide broader access to more insurers.

- Quotes at renewal – Markets change regularly in insurance. Today’s most competitive insurer may not be the most competitive insurer when your policy next renews. The broker negotiates the best terms in the market from a broad range of insurers. At renewal, brokers are responsible for conducting market checks on behalf of our clients to ensure you are getting the most competitive offer.

- We represent you – In the majority of cases, the role of an insurance broker is to represent the interests of the client and not the insurer. Insurance brokers guide you through a claim and advise you on how to get the maximum settlement for your claim.

- Dispute Management – Insurance brokers should facilitate the dispute resolution process. A good insurance broker will help you make a submission to the insurer or the Australian Financial Complaints Authority.

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in the April 2023 edition of The VIC Strata Magazine.

Question: In NSW, is the strata insurance premium dependent on whether lots are owned outright without mortgages? In our block of 10 units, half of the lots are fully owned and mortgage free. Can we get a better deal on our insurance?

Answer: Mortgage status is not a key factor that drives premiums in strata insurance.

Mortgage status is not a factor that increases the risk of a claim from occurring.

Strata insurers will have a benefit covering mortgage discharge costs but such claims only ever happen in very rare cases where the building is destroyed and not replaced.

The cost of offering this benefit is so minor for insurers that all of the insurers we offer this benefit for offer it automatically with no premium saving available for removing cover.

The key factors that drive premiums in strata insurance are:

- Building Sum Insured

- Claims History

- Building Construction

- Occupancy (commercial, residential)

- Location

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

This post appears in Strata News #639.

Question: Is there a regulated fixed percentage scale by which insurance companies increase their premiums each year? If so, what is it?

Answer: Insurance premiums fluctuate year on year and therefore there is no regulated fixed % increase that can be applied.

Insurance premiums fluctuate year on year and therefore there is no regulated fixed % increase that can be applied.

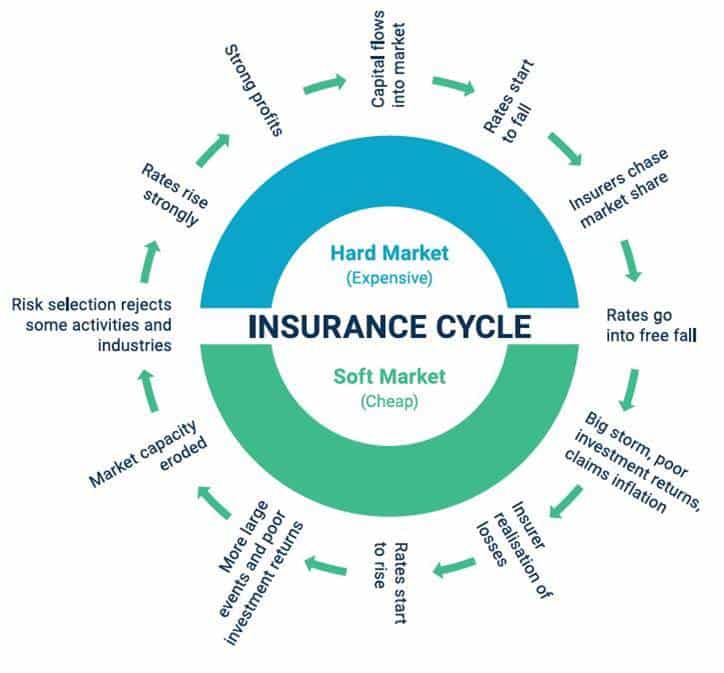

The insurance market works in soft & hard market cycles and commentary suggests it takes 7-8 years to experience a full market cycle – the below diagram provides further context.

In 2015/2016, insurance premiums reduced by as much as 20%

In 2019 the average increase Strata Insurance Solutions experienced for buildings with a sum insured in excess of $10million was 13%-14% and it was a rare occurrence for a client to receive a premium reduction.

More recently, we are experiencing an average premium increase more in the vicinity of say 7%-13% and we are finding this year some clients are getting premium reductions if we quote the market and find a more competitive insurer to the holding insurer.

We believe the strata Insurance Industry is hovering around 10 to 12 O’clock on the Insurance Clock above.

In addition to market movements in premium, you also need to consider individual rating factors for the specific strata building – factors that can mean a higher premium increase specifically for a building can include:

- Adverse claims history;

- Disclosure of combustible building materials (such as cladding and expanded polystyrene);

- Building defects;

- An increase in your building sum insured;

- We are also seeing much higher premium increases in parts of Northern Australia due to cyclone exposure. Gold Coast & Sunshine Coast have also seen premium increases.

We have also noticed more recently strata manager/broker commissions and fees have increased on some policies. Committees who want to find out more should ask their strata manager or broker to provide a breakup of Strata Manager & Broker Commissions/Fees over the last 3-5 years to understand fees/commissions have increased.

If you are unsure about whether the premium you are paying is fair and equitable, we recommend contacting a broker to provide alternate quote. Strata Insurance Solutions have access to in excess of seven insurers and our major point of difference our low fee for service with no payment of commissions to strata managers. For an obligation free quote, contact Tyrone Shandiman on 1300 554 165 or tshandiman@iaa.net.au

Tyrone Shandiman

Strata Insurance Solutions

E: tshandiman@iaa.net.au

P: 1300 554 165

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. Shandit Pty Ltd T/as Strata Insurance Solutions strongly suggests that no person should act specifically on the basis of the information in this document, but should obtain appropriate professional advice based on their own personal circumstances. Shandit Pty Ltd T/As Strata Insurance Solutions is a Corporate Authorised Representative (No. 404246) of Insurance Advisenent Australia AFSL No 240549, ABN 15 003 886 687.

If you have a question about yearly increases to strata insurance for volunteer workers or something to add to the article, leave a comment below.

Read next:

Visit Strata Insurance OR Strata Legislation by State pages.

After a free PDF of this article? Log into your existing LookUpStrata Account to download the printable file. Not a member? Simple – join for free on our Registration page.

Lookup strata did a webinar on strata insurance with John Trowbridge.

You can read it on his website and the webinar is still on YouTube.

John lifts the lid on strata insurance and commissions. Brokers and strata manager commissions are pushing costs up for owners and avoiding transparency.

Strata Managers are still deriving commissions on insurance and say it’s value for money for strata owners. I read John’s report and he doesn’t agree. Fantastic report – those that still receive commissions will argue to the grave it’s good for owners. The the sooner they stop this practice the better.

Thanks Lerwick.

For anyone interested, here is the link to the video you mention on our YouTube channel: Strata commission during the insurance renewal process

We also presented this webinar: Strata Insurance Commissions. Where do you stand?

Thanks

My strata (in the ACT) had a 60% increase in it’s insurance premium this year, even though we have made every effort to improve and maintain our approx. 20 y.o complex of 59 units.

The Strata manager reported that only one insurance provider was willing to quote and we had no choice but to accept it.

We had a big claim after the 2021 storms in Canberra (which has still not been closed out/finalised) and that is the apparent reason why each year since the storm our insurance premium has increased by 25k and 40k respectively.

Our administration fund has been wiped out in the span of 2 years, it is alarming and distressing to be charged so much!

It certainly seems that there has been price gouging and an extreme lack of competition in the insurance sector for stratas.

Laws surrounding compulsory insurance for stratas need to be revised. Surely they were created to protect and incentivise strata owners, not insurers, brokers and real estate companies.

Hi Jessica

I would recommend looking around at alternatives to what has been provided to you by the strata manager.

You may be able to find a better deal through providers that are not associated with the strata manager.

With the reality of more and more low density , (i..e. house and lot) housing is being converted to medium and high density housing, town-houses and apartments; more people are trying to make a living out of Strata-based businesses, and that includes Insurance brokers specialising in Strata Insurance.

I help run a small, 4 lot, self managed group of town-houses.

The former professional managers placed our annual Strata insurance with an insurance broker. associated with the strata managers.

Of course generous generous commissions were paid all round, for this “service” by us, of $476

Our premium. $5,200 arranged through the broker, with an unknown insurer, was for building cover of $$1,519.363 and water damage excess of $3,500, and other exorbitant excesses.

Using a five minute Google search we were able to place our Strata insurance with a very well known company for a premium of $2,140 , building cover of $1,790,000 and water damage excess of $950.

No commissions!

I’ll leave it up to you to decide if you think placing insurance through a broker, because my opinion is unprintable.

Hi Roger

Insurance arrangements vary across the industry and a common approach is for the strata manager to arrange the insurance through providers that pay them a commission.

I do agree committees should explore the alternatives particularly where they are willing to take a more hands on approach to dealing with insurance renewals and quotes each year.

In this instance it appears the new insurance arrangements are more than suitable for you buildings own specific needs.